The Pooled Loan Program has provided over $2 billion in low-cost loans to Vermont governmental units for long-term capital projects over its 50-year history. Loans are primarily funded through the issuance of highly rated tax-exempt bonds by the Bond Bank.

Common uses of loans made through the program include:

|

|

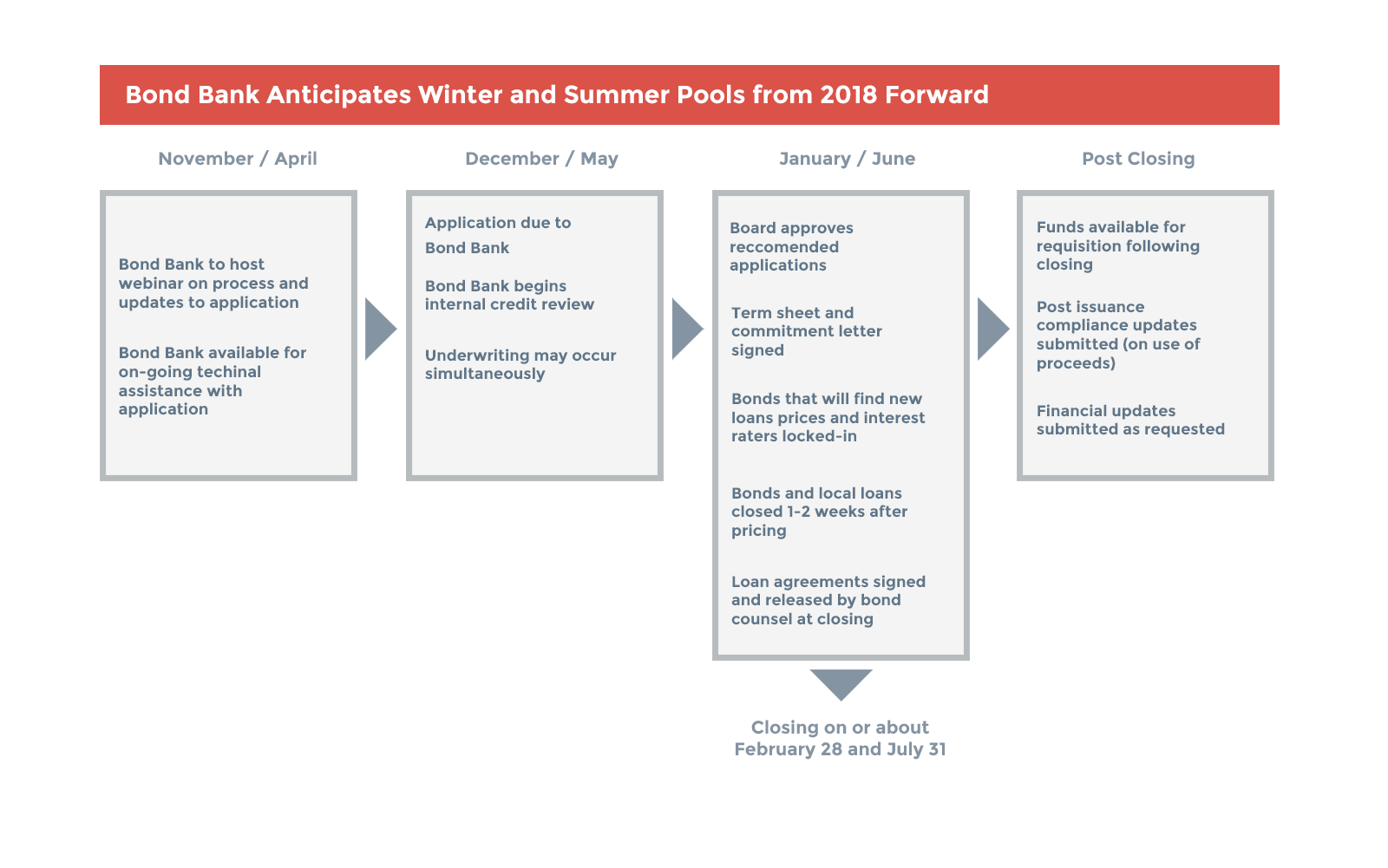

Loan Process

Most borrowers begin their loan process by contacting the Bond Bank early on to receive an illustrative debt service schedule that can be used for the purposes of estimating potential budget impacts. Borrowers then formally apply to the Bond Bank following engagement of local bond counsel and approval to issue the bond.

Loan Specs/FAQs

- Eligible borrowers are governmental units including: cities, towns, schools, villages and various districts

- Require evidence of voter approval and authority

- Legal opinion from local bond counsel

- Annual report for three years or three years of financial audits (preferred)

- Minimum requirement for financial audit from last completed year

- Term of financing and useful life of asset financed must align

- Capital projects and equipment purchases legally allowed for governmental units under Vermont statute

- Winter Pool – Application due in mid-December with closing to occur on or about February 28th

- Summer Pool – Application due in mid-May with closing to occur on or about July 31st

| Loan Amount | Up to 100% financing of project costs |

| Term |

|

| Interest Rate* | Market rate based on the Bond Bank’s “AA+” rating |

| Closing Costs | No fees are charged associated with applying receiving loans through the Bond Bank |

| Payment Dates | Payments are due semi-annually on May 1st (interest only) and November 1st (interest and principal) |

| Drawdown Period | Loans are fully funded at closing |

| Prepayment | Bond Bank must provide consent for prepayment that is based on terms of bonds the Bond Bank issues to fund the loan |

| Requisition of Funds | Funds requisitioned from disbursement account in borrower's name by Disbursement Agent |

| Security | General obligation or revenue bonds |

| Legal | Local bond counsel opinion |

| Environmental | No program requirement other than legal requirements under Vermont statutes |

| Covenants | Annual financial statement submission and timely reporting of material financial events |

| Underwriting / Credit Review | Bond Bank undertakes credit review followed by board approval prior to issuing loan |

| * Based on underlying market conditions |

Approved Loan Bond Counsels

Local bond counsel serves a critical role in confirming the legality of our borrower’s debt issuance. Early engagement of local counsel will ensure that they will be able to provide a preliminary legal opinion alongside a loan application to the Bond Bank. Legal opinions for the Bond Bank require specialized firms that must first be pre-approved.

| Advantages | Considerations |

|---|---|

|

|